capital gains tax changes 2020

The filing of capital gains tax CGT returns and the payment of CGT arising from the disposal of chargeable assets in a particular year is due on or before June 30 and. These will affect those with second homes.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Sarah Hollowell 28062019 To most people it might appear that there have been few changes to the Capital.

. Payable within 30 days. Capital Gains Tax changes April 2020 1. The IRS typically allows you to exclude up to.

New rules for Capital Gains Tax on property sales comes into force from 6 April 2020. Previously it was not necessary to report or pay CGT until you submitted your. Ad The Leading Online Publisher of National and State-specific Legal Documents.

250000 of capital gains on real estate if youre single. The changes affect the Capital Gains Tax CGT. This gives you a 2000 capital gain and because you owned the stock for more than a year you can treat it as a long-term capital gain.

It isnt available for the 2022 tax year it was available. Based on the capital gains tax brackets. Long-Term Capital Gains Taxes.

The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds somewhat to the 22. Americans are facing a long list of tax changes for the 2022 tax year. Capital gains are the profit you make when you sell a capital asset for more money than its cost to you.

The main changes that were made to Capital Gains Tax were regarding the deadlines for paying it after selling a residential property. The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do. In the 2018 Budget former Chancellor Phillip Hammond announced a couple of changes to the capital gains tax CGT regime and reliefs available to owners of a residential.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Ad If youre one of the millions of Americans who invested in stocks. The tax rate on most net capital gain is no higher than 15 for most individuals.

Senate Bill 557 enacted in November 2019 includes several tax changes. The capital gains tax CGT system could be made simpler and fairer by reducing the annual exempt amount and raising rates to match income. The last few years have seen a number of changes to the UKs tax regime with the latest coming into force on April 6th 2020.

Capital Gains Tax. What were the Capital Gains Tax changes. As of January 2020 the standard deduction will increase by 75 percent for all filing statuses and.

500000 of capital gains on real estate if youre married and filing jointly. Or sold a home this past year you might be wondering how to avoid tax on capital gains. How capital gains tax on property will change from April 2020 By.

It is large and easy to read and includes a standard deduction table so that taxpayers do not have. Get Access to the Largest Online Library of Legal Forms for Any State. IRS Restores Capital Gains Tax and Other Tax Return Changes for 2020 General Changes.

Capital Gain Tax Rates. PPR Relief last 9 months. Changes due 6 April 2020.

The 2019 to 2020 tax year is the last year UK residents will be required to pay the Capital Gains Tax for the sale of properties as part of the Self Assessment process and we. Some or all net capital gain may be taxed at 0 if your taxable. When you sell a capital asset such as real estate furniture precious.

For more on long-term capital gains tax rates.

Capital Gains Tax What Is It When Do You Pay It

What You Need To Know About Capital Gains Tax

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Capital Gains Affect Your Taxes H R Block

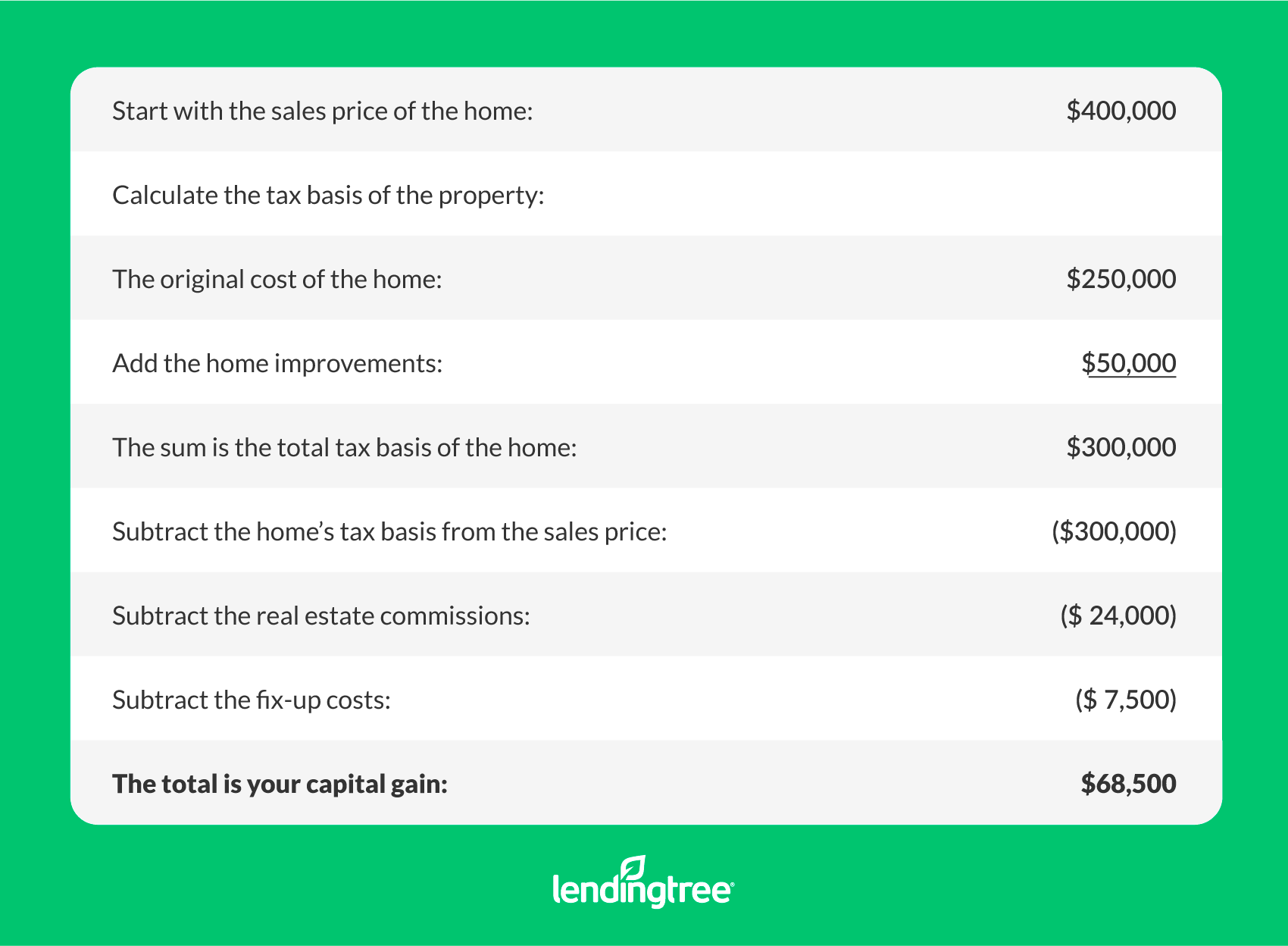

Capital Gains Tax On A Home Sale Lendingtree

What You Need To Know About Capital Gains Tax

What You Need To Know About Capital Gains Tax

How To Pay 0 Capital Gains Taxes With A Six Figure Income

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)